⛔ Solana goes down for ~7 hours

This is Shashank’s Newsletter, a newsletter with bite sized content on everything that happened in web3 over the past week.

In today’s email,

⛔ Solana goes down for ~7 hours

🐦 Why Twitter needs to be decentralized?

📉 Why does macro environment matter?

🫡 Everything is not falling apart

🫘 Some cool beans

It might be bear season now. Stock markets down, Crypto markets down…. 📉

but builders keep building 💪

Some of the best companies from America were started during recessions like Microsoft (1973-75), Google (2000-02), Uber, Airbnb (2007-09). Most successful entrepreneurs tend to thrive in these changing markets.

As these iconic brands have shown us, there should be nothing that stops you from chasing your dreams 🔥

⛔ Solana goes down for ~7 hours

Solana blockchain halted and stopped adding new blocks for a whole 7 hours. It required co-ordination across 600 validators to restart the cluster.

So, what caused this? Solana has been seeing increased bot activity that mint NFTs when they get listed and then immediately sell them for $$ on other marketplaces. There are also other types of bots that arbitrage token prices, liquidate loans etc.

How did it happen? Solana validators received over 6 million transactions per second. This large DDoS style attack had 2 main effects:

The physical network cards on validators got overwhelmed. Data centre & network providers chose to cut off the network to some validators.

At the same time, the large network flood caused validator nodes to evaluate multiple forks and spin up multiple threads causing classic Out of memory errors. For instance, Validator A produces a block, Validator B can't see it yet because of the network flood. Validator B produces a block which is now on a new fork. Validator C sees both blocks and must decided which fork is right. As this situation exacerbates, validators have to keep track of several multiple forks. This drastically ramps up RAM usage eventually crashing it.

So, some validators are cut off by network providers and some have crashed due to high RAM usage. Once they crash, validators are no longer validating transactions and contributing to consensus. After a point, network ceases to advance without 66% consensus and halts.

What was the solution? Validators then sample their local states & identify the highest optimistically confirmed slot. With a cluster restart, they were able to start from the highest optimistic slot, meaning no confirmed transactions are lost and state resumes from where it left off.

However this didn't really change much for users, as most interact with the blockchain through RPC nodes which hadn't restarted yet. It would take few more hours for these nodes to come back up.

What are they doing to avoid this? Validators are implementing changes to penalize bots and add fee based execution priority. Solana core devs also plan to switch to QUIC (Google’s advanced implementation of UDP) to pass transactions.

The decision to penalize bots turned out to be a very controversial decision and in many ways against the web3 philosophy of censorship resistance. If validators can censor bots, they have the ability to censor any of your transactions in the future which defeats one of the core primitives of web3. These were the cluster restart instructions laid out by Solana foundation to manually censor bots.

But majority of the validators did not choose to go down this path as they felt strongly against censorship resistance.

If you are an engineer, you know how hard building scalable solutions can be. These are not desirable situations for devs or users of the blockchain. Now, the network is back up and blocks are being produced. A big shout out to the Solana community to get together and overcome this hurdle. But hopefully they learn from these challenges and address the core issues. 🚧

🐦 Why Twitter needs to be decentralized?

Many of you might have heard about the news of Elon taking Twitter private and this has sparked several conversations around how it can embrace web3. One of the great thought leaders in web3 and consumer social space, Sriram talked about the importance of decentralized social media on a pod. Here are some of the key points:

⚙️ Need for a base protocol layer: Let’s go back in time and take some analogies from email. We use a base protocol layer like IMAP/ SMTP which provides the basic functionality of sending and receiving email. Application layers like Gmail, Outlook, Superhuman are essentially clients which run sophisticated AI/ ML to build better search, categorization, spam detection etc. Gmail cannot ban you from receiving email, but….. Twitter can ban you from access to twitter. Thats why it’s important to separate the protocol from the application.

❌ Right to exit: With email, you can easily switch to a different client if you are unhappy with a certain client. Twitter does not provide a way to export all of your content and followers to switch to a different social media layer. With the options of several clients operating on the same base protocol, consumers always own the data have the right to exit and choose any client/ algorithm of their choice.

💰 Need for economic incentives: Creators who have millions of followers get nothing in return for engaging so many consumers on the platform. Instead, social media platforms keep all of the ad profits and don’t share any of it with the creators/consumers. Creators need to be paid for the value they bring to the platform and tokens are a programmatic way of formalizing this.

🫶 Need for Governance: These tokens also give the right to Governance and could be used to govern how Twitter handles key issues like free speech, manage treasury money etc. Token holders also become stakeholders.

There have been some experiments in the space already and Lens protocol is one of the most exciting projects I’ve seen building towards this mission. Lens is building the base layer protocol with primitives such as profile, posts, comments, followers etc. and have devs build on top of this decentralized social graph layer. If you are interested in building on Lens and believe its time for a revolution, highly recommend checking out their docs. 🚀

📉 Why does macro environment matter?

We usually talk about crypto from a tech perspective but let’s take a moment to think about it from a macro perspective. Raoul Pal, legendary hedge fund manager shares a lot of golden nuggets on how the macro environment can impact crypto markets.

Shape of global market: Global markets have been through a very complicated situation with countries fighting a virus, countries fighting wars, countries printing money and very high inflation.

Impact of inflation: The institutions are spending more on energy costs. You spend more on commodity costs. But people’s wages are not increasing at the same rate as rising costs. This is going to squeeze everybody's liquid cash. On top of this, the Fed reserve is increasing interest rates aggressively to tighten the liquidity further.

What does this mean for crypto markets? Liquidity is coming out which affects risk assets such as crypto. Particularly, new adoption into crypto markets will slow down due to these factors. As new adoption slows, network effects of crypto assets reduce and hence their value declines.

Where do we go from here? As inflation eases, new users will be on-boarded and several new use cases will be unlocked thanks to the talented pool of builders. There will be a lot of capital on the sidelines. Given the opportunity for a bounce, the market will bounce, which, in recession times and low growth environments, could potentially move to assets that are bound to work in an exponential timeline and crypto could lead the way.

The world is set up for an amazing cycle of growth and opportunity. Don’t get scared out. Be a part of what is going to be a great future 💪

🫡 Everything is not falling apart

You might have heard of silicon valley companies like Fast, WeWork and many more that burned a lot of money and made a lot of news. I feel that there are fewer people who share positive news about startups that do the opposite….. profitable startups, not burning a lot of money (like a psychopath?)

Dune is a web3 startup that lets you analyze blockchain data through SQL and makes on-chain crypto data accessible and consumable. Analysts, traders, enthusiastic data nerds make up the community. They create and openly share their queries which can then be forked and remixed in a multitude of ways by others.

It’s really inspiring to see that they have 25 years of runway with their current revenue. They even reached a unicorn valuation with just 16 employees 🦄

🫘 Some cool beans

Uniswap, a decentralized crypto exchange now has the deepest liquidity for exchanging ETH and USD compared to centralized exchanges like Coinbase, Binance, Kraken. Huge props to Uniswap for achieving this amazing feat 🏅

Google Cloud is reportedly starting a team to be focussed solely on web3 and enable developers to build web3 apps using Google resources 🧑💻

Opensea had the largest EVER trading volume of $500M on May 1 💰 This is contrary to WSJ’s article which suggests NFT sales are dying. Reminder to always read from trusted sources. It’s also important to read from conflicting sources, but most important is to make your own opinion.

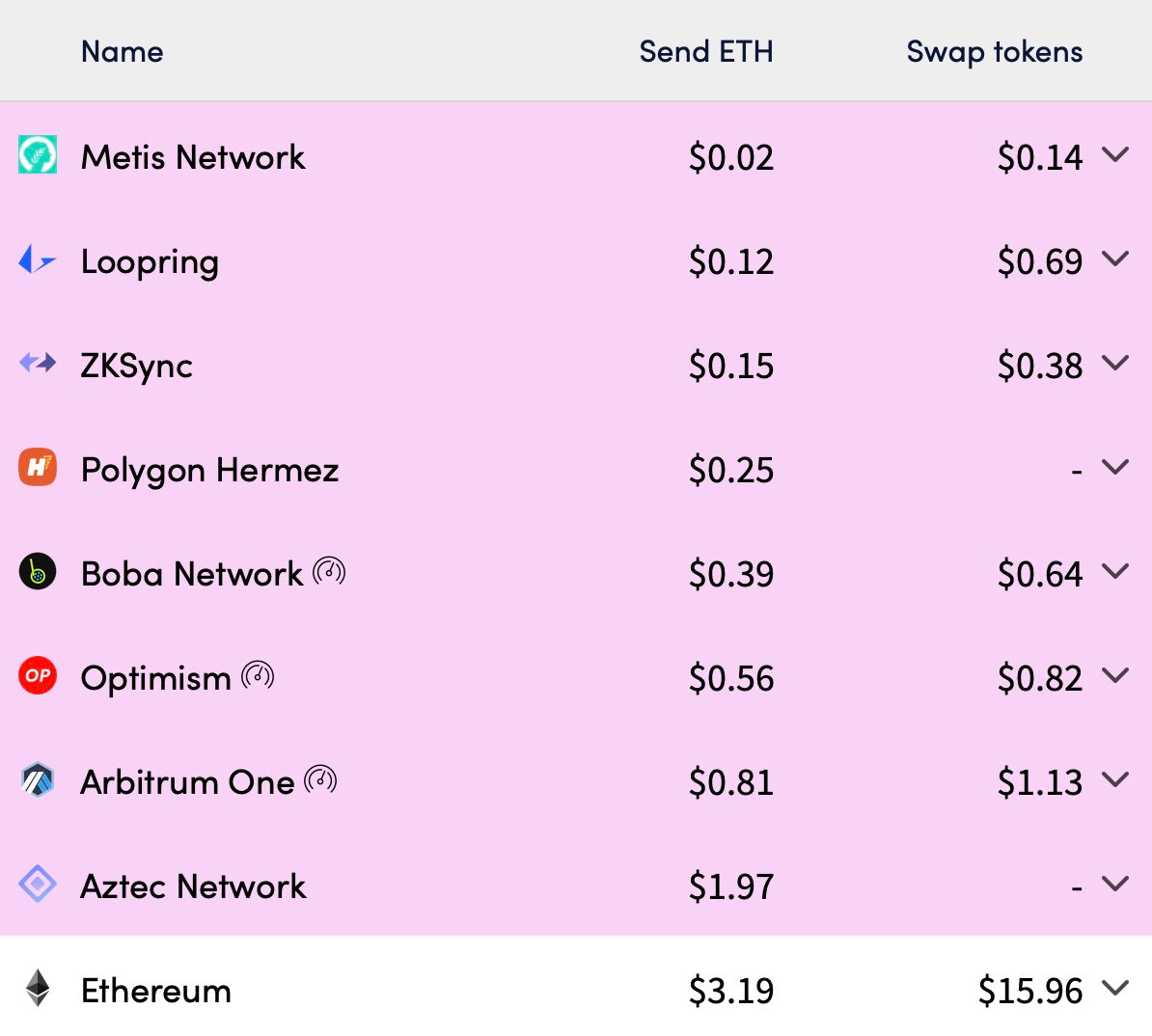

Low transaction fees are here on ETH on Layer 2 and wish it’s more widely adopted to avoid gas wars like the recent Yugalabs launch. There are several L2s with transaction fees under $1 ⚡

How did you enjoy this week’s edition?