🦧 $300M sold in the largest NFT launch

This is Shashank’s Newsletter, a newsletter with bite sized content on everything that happened in web3 over the past week.

In today’s email,

🦧 $300M sold in the largest NFT launch

💎 Opensea buys Gem

🏀 DAO buys a basketball team

👪 Community led DeFi investing - Babylon Finance

🫘 Some cool beans

ETH Q1 report by Bankless 📈

Main highlights from the report:

Network revenue from transaction fees increased 46% from $1.6B to $2.4B 📈

ETH staked to secure the blockchain rose 111% from $5M to $10M 📈

Value in DeFi protocols increased 82% from $49.1 billion to $89.5 billion 📈

Stablecoin circulating supply rose 188% from $42.3B to $122.1B 📈

NFT trading volume increased 19,290% from $606.3M to $116.4B 🤯

Here’s a snapshot of the protocol results:

If this was the report of a public company on NYSE, where would the stock go?

To the moon baby…. 🚀

🦧 $300M sold in the largest NFT launch

Yuga Labs announced the launch of their metaverse called Otherside back in March. Yesterday, they launched the sale of “virtual land” in this metaverse called Otherdeeds.

What is the Otherside? At its heart, it is a metaverse for all NFTs: Bored Apes, Mutants, Cryptopunks and other popular NFT collections will have 3D models ready for use on launch. There will also be developer SDKs to build out more in the future.

What is Otherdeeds? Otherdeeds is a tokenized representation of land with attributes in this metaverse. Each land is a dynamic NFT with its various elements changing depending on what you do in the game. It EVOLVES as you participate - the next stage of NFTs.

Launch details: Each land sold for 305 $APE each ~$6k. This was one of THE MOST hyped launches. Look at the buy pressure on $APE token in the past week…. during bear season.

So, how did the launch go? Things got pretty wild. Yuga Labs made an eye-popping $300M from the NFT sale. But there was a huge gas war with people trying to mint NFTs at the same time and the gas reached ~7000 gwei (gas unit in Ethereum) ~$400 for a transaction (due to network congestion). The total amount of gas spent for the NFTs was $175M. 🤯 This has been the largest public mint to date on the Ethereum network accounting for ~60% of Ethereum gas fees. (Btw great thread on how Yuga devs could have optimized their code to avoid this. Good read if you are into solidity) ⛽

These kinds of big hype events and network congestions clearly shows how much there is to build and how early we are into scaling this!!! See you devs on the “otherside” 🚧

💎 Opensea buys a Gem

Opensea, the leading NFT marketplace bought Gem for several millions $$$. Gem is a trending NFT marketplace aggregator which lets you buy and sell NFTs across different marketplaces such as Opensea, LooksRare, NFTX in a single transaction. It also lets users pay with multiple tokens and has several advanced features, basically making it easier for large collectors to interact with the NFT markets. You can think of it like: Alibaba for NFTs.

Why is Gem so popular? Two words - Community Obsession. Gem released several features constantly listening to community feedback such as shopping cart, rarity info, whales purchase notifications, flashbot protection and others that help users save fees. This has allowed Gem to naturally absorb users and be the leading marketplace aggregator. Many of these features were also requested by Opensea community but went unheard.

Why Opensea? Although, this acquisition seems a bit counter-intuitive for Opensea at first sight to integrate listings from other marketplaces, it’s trying to primarily serve power users who bring in lot of $$$. With the massive war chest of 300M that Opensea raised, expect to see much more M&A activity as Opensea strengthens its position in the NFT ecosystem.

Why the acquisition? Gem has shown impressive market share metrics like

~15-20% of Opensea user base (primarily power users)

~20% of Opensea volume

20x growth rate in one quarter. $1M in transaction volume a day in Jan to $20M in April

Several fear that similar to web2, small but beautiful companies get acquired by giants and then fall down. Genie, the second largest NFT marketplace aggregator is trying to capitalize on this moment by launching their own token $GENIE to build a more community-oriented and decentralized ecosystem than Opensea. NFT wars are getting very fierce 🔥

🏀 DAO buys a Basketball Team

DeGods DAO which owns one of the largest NFT projects in Solana, just bought a friggin Basketball team in the Big3 League. Web3 projects are really shooting for the moon. 🤯

What is Big3? The Big3 is a professional 3-on-3 basketball league focussed on entertainment with former NBA players and Hall of Fame coaches. The games alone amass a TV audience that is larger than other major sports leagues like MLS and NHL.

What is in it for DeGods? DeGods will have their logo on the jerseys alongside companies like Microsoft. Aside from the DeGods logo, name on the broadcast graphics, and all the other obvious things with owning a team, the DAO will have a new funnel to market, produce content, sell team merchandise, tickets and IP. There are no limits on *how* to do this and innovate in the space.

Will more NFT projects be taking teams on? You bet.

Will more NFT projects be used as crowdsourcing mechanisms for creative projects? Absolutely.

👪 Community led DeFi investing - Babylon Finance

Babylon Finance is a community-led, asset management protocol built on Ethereum.

Why is this relevant? Let’s look at the recent trends

Macro environment: Equities are low. Inflation is high. Savings interest rates are almost 0.

Rise of social investing: Wall Street Bets, dogecoin have shown the power of investing as a tribe. With a tribe, you can find people that share your viewpoint, build on it, and spread it.

Risk of centralized platforms: Robinhood has made everyone aware of the risk that, if you are not paying to use a platform, you are the product.

Web3 turns the entire world into investors - Balaji Srinivasan

Combine all the above trends, we see open, permissionless and transparent platforms like Babylon finance.

What are they trying to solve exactly? There are so many opportunities in crypto but very few people know how to find them. What if the people that know the opportunities share them and get rewarded?

How are they solving it?

Gardens: Gardens are the investment communities of Babylon Finance. To join a Garden, you need to deposit a reserve asset like ETH or DAI of the garden. Once a member, you can propose investment strategies, vote on strategies, and receive rewards for participating in governance of the Garden. Cool part is that the cost of executing DeFi strategies is shared by all members. Here’s one of their popular gardens that lets users deposit $DAI and earn ~40% APY. This APY includes the average return of ~12% return from all the strategies + ~7K BABL rewards -> ~40%. BABL is the native token of the platform.

Profits and Fees: In TradFi, the fee structure is typically 2% management fee on deposits and 20% on profits. Babylon greatly reduces these fees by having 0.5% and 5%. Those fees get distributed eventually to BABL holders.

It is up to the creator of the Garden on how the other 95% of the profits get split up. They could distribute slightly more of the profits to Strategists and Voters to encourage participation in the Garden.

What a better goal than helping thousands of people reach financial independence!!! 🚀🚀🚀

🫘 Some cool beans

Bullish news for Bitcoin as Fidelity is adding BTC as an option for 401(k) retirement plans later this year. You can now have up to 20% of your retirement portfolio in BTC. Fidelity manages over 2T$ in long term assets and it will bring on a new wave of traditional financial investors to BTC which is great news for mass adoption of BTC🧓🏻💪

MagicEden, the largest NFT marketplace on Solana is crushing their growth numbers with 55% more users and 635% more transactions compared to OpenSea 📈

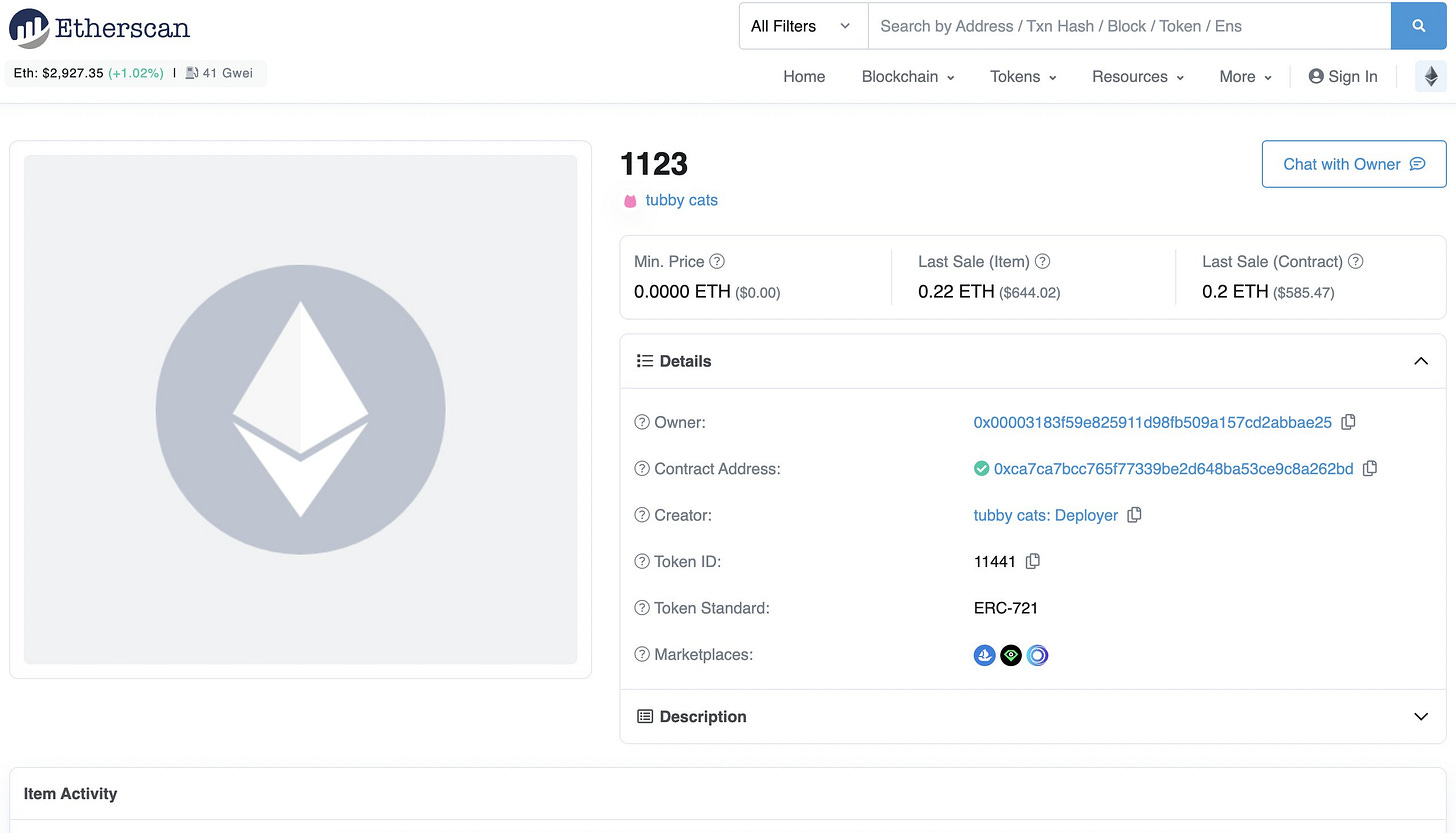

Etherscan, a free tool to explore blockchain transactions secretly released a feature to preview NFTs and also "chat with owner". Is Etherscan joining the NFT marketplace wars? ⚔️

How did you enjoy this week’s edition?