🌑 The Luna eclipse

This is Shashank’s Newsletter, a newsletter with bite sized content on everything that happened in web3 over the past week.

It has been a crazy week of chaos and panic in crypto. First up, I hope you guys are doing okay. Don’t feel too depressed or worried about stock/ crypto prices…. for not all things are under our control always.

Take some time away from the charts. Remember to take care of yourselves and learn through the journey.

I thought I’d share a viral crypto meme that cracked me up

This week’s email is primarily focussed on the UST collapse. I also shed some positive crypto vibes at the end cos that’s what we need now :)

Chart of the day - Fundamentals

Good time to refresh and focus on fundamentals if you are looking to invest in protocols. This is a chart of top dapps and their P/E ratio.

P/E ratio is calculated as fully diluted market cap / annualized protocol revenue.

🌑 The Luna eclipse

This story is a bit personal as I was also a believer in UST and the need for a truly decentralized stablecoin (not backed by assets which could be frozen by a central governing organization). I was one of the millions who saw their $$ drown. Luckily, it was a small percentage of my portfolio and I alleviated the pain partially by taking early actions before the collapse on Tuesday. Pouring out a whiskey to all the UST shenanigans 🥃

So what happened?

The third-largest stablecoin UST and one of the biggest blockchains collapsed. The stablecoin came down from a stable $1 to a highly unstable $0.19

What is UST?

UST is an algorithmic stablecoin which works with its sister token, LUNA, to maintain a price around $1 using mint and burn mechanics. In theory, these mechanics are supposed to ensure $1 worth of UST can be used to mint $1 of LUNA.

This part is really important - the system relies on arbitrage to maintain the peg. For example, if UST is selling at 90 cents, an arbitrager is incentivized to buy UST for 90 cents and sell it for $1 worth LUNA and vice-versa eventually bringing back the peg to $1.

But arbitrage works *only if* people want to do that.

How did UST grow?

Main utility of the UST stablecoin is the Anchor Protocol which pays 19.5% yield which incentivizes liquidity. This 19.5% is supported by the Luna Foundation Guard led by Do Kwon (kinda like the Fed Reserve for Terra). There were known risks on the long-term sustainability of this interest rate and the team was starting to address it.

How did the events unfold?

Context: Most stable coin swaps (UST <> USDC, UST <> DAI, UST <> USDT) are done on Curve which is one of the most efficient decentralized exchanges to swap stable coins with low slippage (similar to Uniswap but specialized for stable coin swaps). Curve has pools containing different stable coins. As liquidity reduces in the pool, the more likely a stablecoin could lose the peg.

Sell pressure on UST

Do Kwon removed 150M UST from Curve for 4Pool migration. (This migration would help Terra diversify revenue outside of just Anchor protocol).

At the same time, he was also selling UST to buy BTC to build up reserves. (Ironically, to avoid a bank run situation)

Attack

Stage is now set. Attacker started their attack at a perfect time by dumping $350M of UST from Curve. This caused the liquidity to dry up and peg to fall to 0.972.

LFG begins selling 750M BTC reserves to defend the peg and buy UST, causing downward pressure on BTC while the bank run on UST was just getting started. Their avg buy price of BTC was $42k and were now selling at $30k (due to macro sell off) making the fight weaker for LFG.

Attacker lands a massive counter punch by dumping another $650M of UST from Binance since Curve liquidity was already dry. UST de-pegs to $0.60 at the bottom now, while BTC bleeds out.

UST balance on Curve drifting from 50% Panic

People started panicking and dumping UST from centralized exchanges. Eventually, the exchanges had to suspend withdrawals of UST, fueling more panic among people. This panic also moved to Anchor protocol as it saw massive withdrawals kickstarting the death spiral.

UST deposits in Anchor in Yellow - smart stake Hyperinflation: Massive withdrawals of UST caused immense pressure on LUNA (as demand for UST reduces, LUNA price reduces). With liquidity gone, the only way in which UST holders can exit the system was through redemptions, i.e. minting new LUNA and selling it on the open market. This caused the circulating supply of LUNA to hyperinflate 8190% from 386 million to 32 billion+, causing the price of LUNA to drop 99% from $31 to $0.01 during this period essentially wiping away $41B in value.

What were the main learnings?

Impact on human Lives: Reddit threads from terra groups are filled with people talking about suicides which is extremely sad. Crypto has real risks. So, please invest amounts that you are only willing to lose. Also, remember to check in on the mental health of friends & family.

Decentralization on paper: UST was a decentralized algorithmic stablecoin on paper but in reality the system required an incredible amount of human intervention and closed-door deals in order to function properly. LFG was acting as the Federal reserve of Terra trying to take actions manually to stabilize the system. This was neither decentralized nor algorithmic.

Regulation: Fed reserve is going to clamp down on stable coins due to the nature of peg to USD. Un-collaterized stable coins like UST specifically will get more attention from them.

Humility: We don’t just need smart people in crypto but also good people. Influencers on Twitter are setting back the industry by shilling their bags. Founders like Do Kwon are dumping their ego by attacking critics and making public bets on Twitter. We need more helpful and humble hosts in crypto.

Need for privacy infrastructure: Large traders should be more careful with exposing their on-chain behavior. LFG exposed their large BTC transfers, which created the best timing for attackers to attack with 350M.

Some advice for you

Use this opportunity to become a better investor. Take profits, size your bets and don’t go all-in. All the best investors have fumbled multiple times. Take the time to understand the fundamentals and risk of this space.

Better yet, if you could become a builder instead of an investor. Speculate with your talent and not capital as your capital might be limited but there is no limit to your learning potential. Bear markets give an opportunity to get involved on the ground floor of next generation companies.

🫘 Some positive vibes

Uniswap getting close to a huge milestone with cumulative trading volume reaching a trillion dollars. This is a huge accomplishment for a decentralized platform. Respect and admiration to the Uniswap team 🫡

Amidst all the down market trends and UST collapse, Curve Finance benefitted a lot as they hit their highest ever daily volume of $5.8 billion on Ethereum. They were able to handle the large volume of stablecoin transactions without any issues 📈

Instagram launches ability to share NFTs on feed, stories and messaging. They integrated with multiple chains like Ethereum, Polygon, Solana and Flow. With larger companies like Coinbase and Meta integrating NFTs, the reach and use cases for NFTs could become more mainstream ✨

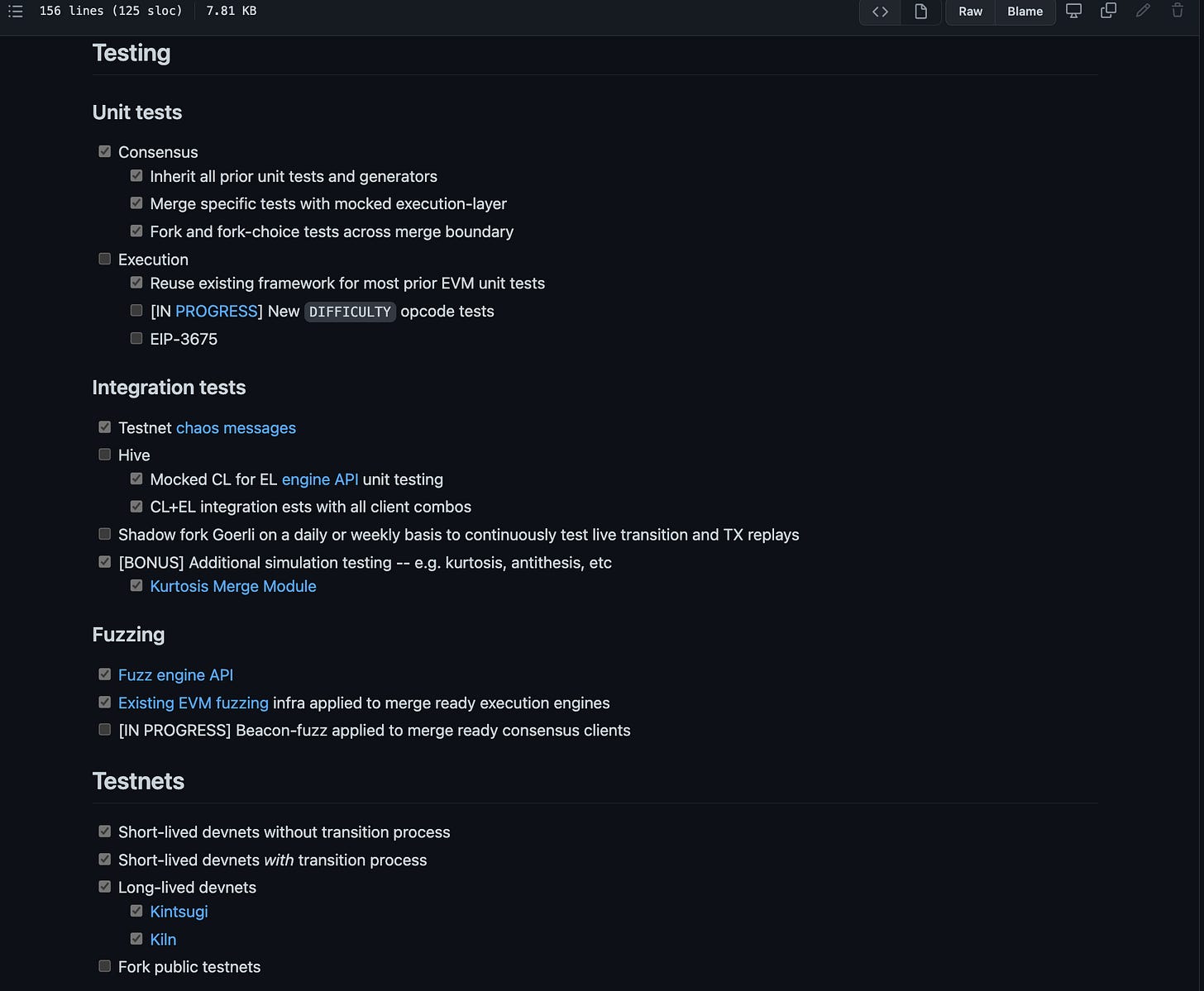

Market might be down but devs are chugging code and shipping. Ethereum's testnet will perform the merge transition (largest network upgrade to ETH) on June 8th. Check out the mainnet readiness checklist where you can track the status in real-time 🚂

In more TradFi adoption news, Brazil’s largest digital bank, Nubank, launches Ethereum trading and 3 new BTC/ ETH ETFs will begin trading in Australia 🏦

How did you enjoy this week’s edition?