🏗️ State of crypto 2022

This is Shashank’s Newsletter, a newsletter with bite sized content on everything that happened in web3 over the past week.

First up, I wanted to share a really exciting personal update. I’m putting my money where my mouth is and am switching full time to work on web3 to help Bitski build wallets and onboard the “normies” onto web3.

As much skepticism as there is on web3, I think it’s a greenfield opportunity to design and build new systems which is really exciting to me as a builder. In terms of timing, I think we are at an inflection point in crypto’s trajectory as the industry transforms from a niche to mainstream.

Quoting some timeless philosophy from Naval on making important decisions

Your success depends on your ability to make good decisions. Your happiness depends on your ability to to not care about the outcome.

Big things to come 💪🏻

Nuf about me. Now let’s go to it…

In today’s email,

🏗️ State of crypto 2022

🪙 Coinbase makes web3 simpler

🔐 Robinhood launches a self custody wallet

💰 Bot makes 500k in 3months in a crypto game

🫘 Some cool beans

Meme of the day

🏗️ State of crypto 2022

a16z released a report on State of Crypto 2022 packed with strong takeaways and really insightful trends. Some of the highlights:

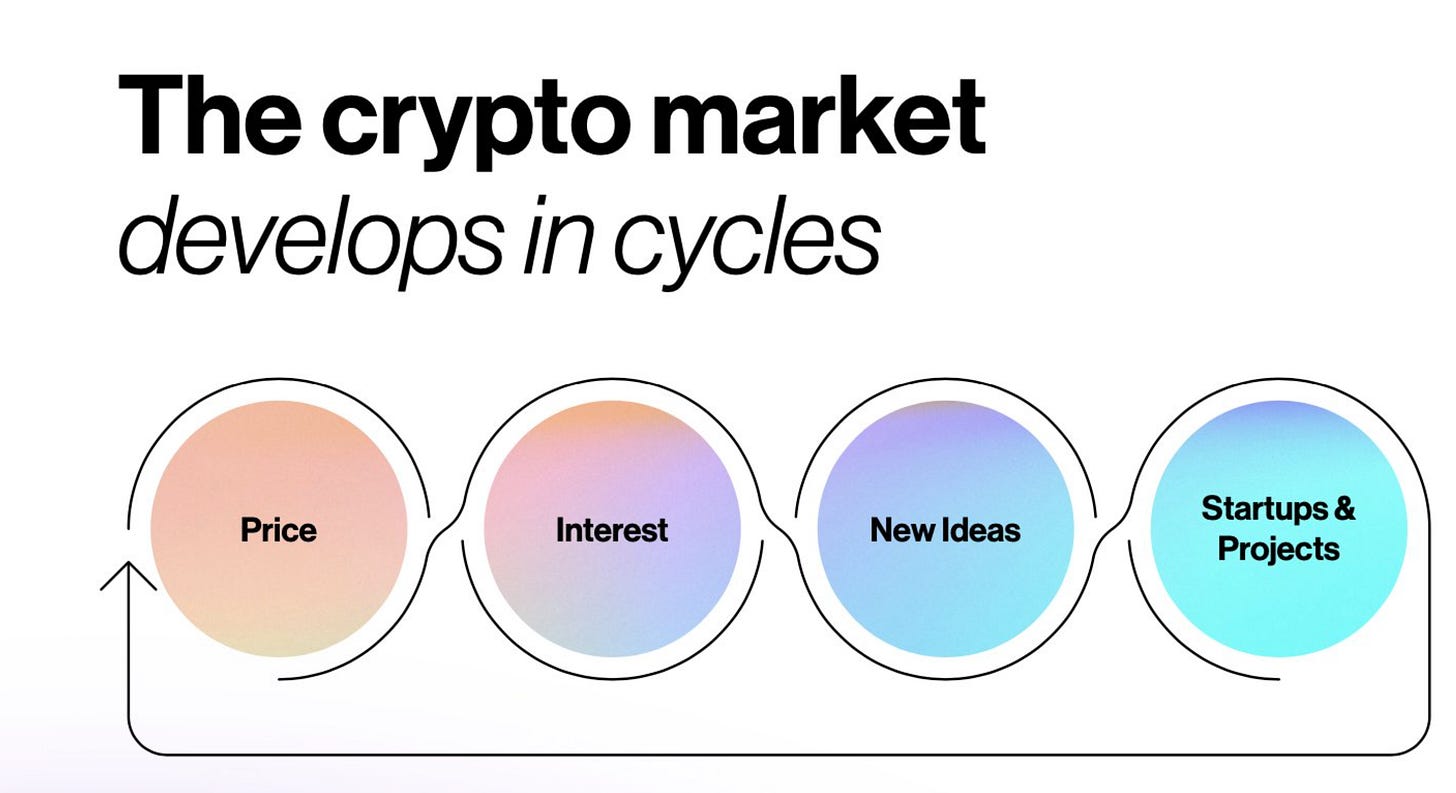

Crypto markets have a very nice feedback loop where prices attract talented builders who stick through bear markets and build innovative projects…. which eventually act as catalysts to drive prices. Let’s keep building!!!

Web3 creates highly efficient and lean platforms by removing middlemen. This is a comparison of take rates across different creator platforms:

These low take rates mean that most of the value gets accrued to the creators. Here are the estimated creator revenues across platforms:

The global, open, financial platforms built on Ethereum aka Defi is competing with the biggest banks and could help bank several under-served populations.

Comparing Ethereum and Internet user growth over time, we are still really really early and far away from hitting a billion users.

This is a really informative and inspiring report for all the builders to drive clear use-cases and seamless experiences.

🪙 Coinbase makes web3 simpler

Coinbase announced a couple of features that seem simple on the outset but are drastically making interactions with web3 apps simpler and building on a very large vision. These are the recent announcements:

Coinbase is allowing easy access to several web3 apps such as Uniswap, Opensea, Compound etc. through its new browser tab right on the Coinbase app. This functionality was already available in some form on their self custody app aka Coinbase wallet.

So why was this such a big deal? They are now bringing this functionality to the main Coinbase app using a new technology called MPC (multi-party computation).

So what is MPC? In simple terms, it’s a balance between custodial and non-custodial wallets. This semi-custodial wallet system requires some part of the key to be on the users device and some part to be with Coinbase. Even if one part is lost, you can recover the wallet. In complex terms, it uses advanced cryptographic techniques to achieve this interactive multi party transaction signing.

Outside the technology, this browse experience could make Coinbase the default AppStore for web3 which could be potentially huge 🏪

How many times have you had to manually transfer crypto across wallets to use Dapps? In addition to making multiple transfers, you had to manually paste long wallet addresses which gives even the pro-crypto users a mini heart attack every time they do it. To solve this clunky and insecure experience, Coinbase announced Coinbase Pay to allow easy crypto on-ramp solution using their SDK. Dapps can now use this SDK to enable seamless crypto and fiat transfers straight in their app. These apps now, also get access to 80M+ KYCd users and fraud protection which is a big deal for several financial apps. They have already signed Metamask as their first customer 🚀

🔐 Robinhood launches a self-custody wallet

Robinhood has been slowly embracing web3 ethos and rolling out products. Vlad calls this pivot to web3 as their third evolution of the company (aka Robinhood3) after commission free trading of stocks and embracing crypto as an investment class.

They first allowed low fee crypto trading, then crypto withdrawals to other wallets. Now, they announced a stand alone app to self custody crypto assets in a wallet.

Vlad mentioned some of the main design principles behind this wallet:

Mobile first design instead of building web extensions and desktop sites like other wallets. They are going to bring their user friendly and highly responsive design for native. web3 wallets. The best companies are always playing to their strengths and mobile first design is one of the fire powers behind Robinhood.

Simpler onboarding without relying on seed phrases and providing easier recovery

Better UX for accessing Defi protocols without having to use a clunky in-app browser

Multi-chain support including Ethereum and it’s layer2s, Solana and others

All in all, these features are going to unlock a ton of value in on-boarding it’s 17M users to native web3 applications 🔓

💰 Bot makes 500k in 3months in a crypto game

What is Crabada? It is a play-to-earn game where your “Crabs” are represented as NFTs. Crabs can be sent as a team of three to mine specific locations on the map. Players can send them to loot other players' treasury in looting for a higher reward than mining. But the players can successfully defend their treasury, thus failing the looting expedition.

Winning teams would get $60 and these incentives attracted several bots to play the game. There was one bot which used a unique strategy to win against other looting bots.

How did the bot work? The bot watched the Crabada game contract for new mines and only attacked mines less than 3secs old. The bot also scanned other successful looters transactions every 2 mins and used a gas fee 20% higher than other looters to increase the chances of getting a successful transaction. The bot also used other optimizations to reduce latency significantly. Here’s the link to the source code if you are interested.

Stats: Bot attacked using 3 teams and earned an average $4k per day & $10k per day at peak, making over $500k over the 100 days period 🤯

🫘 Some cool beans

Nansen’s NFT500 index consists of top NFT collections on Ethereum by market cap similar to the famous S&P500 index. Interestingly, this index is up over the year unlike the S&P500 (worth noting that the NFT index is tracked on ETH instead of USD). These top NFTs are like luxury Gucci handbags which don't really lose value in bear markets and the holders tend to be more attached to their collections

One of the greatest trades in history? $770 → $1.4M

a16z has launched a $600M web3 gaming fund called Games Fund One to invest in gaming studios, apps and infrastructure tools.

Cloudflare launches a new web3 experiment to become a Proof of stake validator on the Ethereum network as it closes in on The Merge. This means that they will launch, and fully stake, Ethereum validator nodes on the Cloudflare global network.

How did you enjoy this week’s edition?