🆕 How to hedge against inflation using stablecoins?

This is Shashank’s Newsletter, a newsletter with bite sized content on everything that happened in web3 over the past week.

In today’s email,

🆕 How to hedge against inflation using stablecoins?

🕉️ Introducing OM, Open metaverse

🪙 How to evaluate tokens?

🫘 Quick nuggets

Some alpha 💎

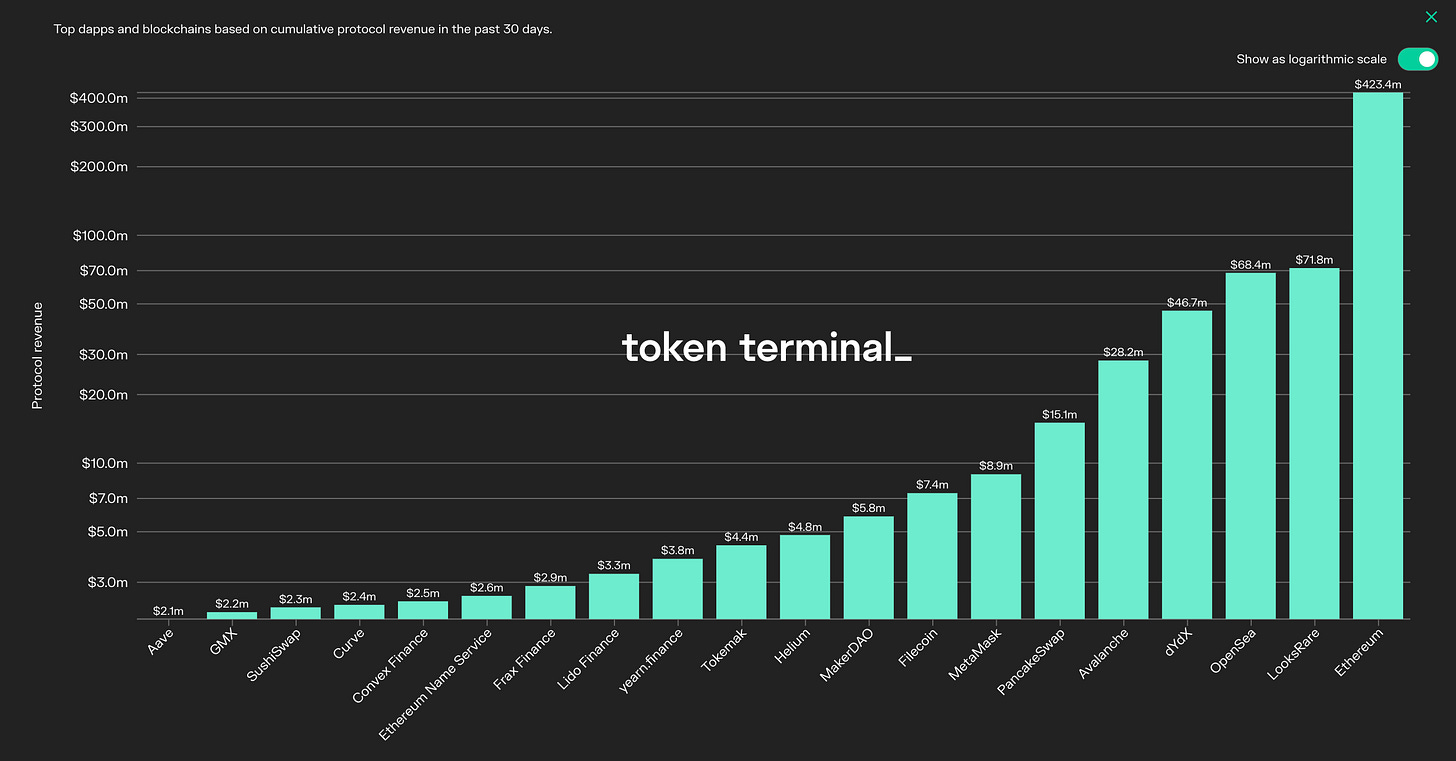

Emerging player with very little attention… slowly gaining protocol revenue: Tokemak 📈 $TOKE is ranked 11th in crypto protocol revenue for the past 30 days at $4.4M

Tokemak offers a new method for creating DeFi liquidity for trading on exchanges. DeFi liquidity plays an important role in determining the movement of token prices. I’ll do a deep dive on this soon.

🆕 How to hedge against inflation using stablecoins?

We’ve all been hearing about inflation and how our dollar is worth 8.5% lower than it was before. 📉

So whats a good way to hedge against this? Enter Frax Price Index $FPI 🥁 Frax finance kills inflation with Stablecoin 2.0. We talked about the fractional algorithmic stablecoin $FRAX in our last post. Frax finance has now launched $FPI, a next-gen stablecoin that is immune to inflation. Talk about timing a launch and $FPI is entering the market at the perfect time to ride the inflation narrative for broad adoption.

So how does this work? There are 2 tokens:

$FPI, the inflation adjusted stable coin. Basically think of $FPI as a dollar but the yield of this token == inflation. So, if the price of $FPI is $1.00 today, it would be $1.10 one year from now at 10% inflation rate. Inflation rate is tracked using government data sources on the consumer price index in a smart contract, all autonomously.

$FPIS, the value accrual token. As the demand for $FPI grows, the value of $FPIS increases similar to the relationship between UST and LUNA as we spoke about in earlier post.

So how can $FPI magically increase in value with inflation? The value is not created out of thin air. The value comes from treasury yields of Frax finance. If treasury yields 5% and inflation is 1%, portion of the treasury is used towards buying enough FPI to increase its value. If treasury yields are lower than inflation, $FPIS comes to the rescue and is sold off to the market to increase the treasury.

Just like $FRAX is a stable coin aka crypto dollar, you can think of $FPI as crypto bond indexed to inflation. The market size of TIPS (Treasury inflation-protected securities) issued by US Treasury is $1.5T 🤯 showing the massive potential of the crypto bond space. We are still so early in building out such financial primitives in a decentralized and permissionless manner.

These are the kinds of innovations that makes me super bullish on web3 and DeFi in particular. 🚀

🕉️ Introducing OM, Open metaverse

punk6529 is one of the OG crypto personalities and they just launched an alpha product called OM. It is a decentralized open metaverse that can scale to 100 million people.

Main design philosophies for OM:

a) decentralized and open

b) easy to use on a browser

c) globally affordable

d) bridge to the physical world

Creators along with the community, can create virtual districts using modular spaces to hang out in the metaverse. For the alpha version, punk6529 created the Museum district showcasing all of their NFTs. The goal for this district is Education, a place to get people educated on NFTs, from basic to advanced level. People can create their own districts and narratives in OM. Highly recommend checking out and playing with the alpha website here.

Successfully building an open metaverse won’t be easy. I love such bold ideas where the plan is hard, the mission is almost impossible and the odds are stacked against them…. but, isn't it more fun that way?

🪙 How to evaluate tokens?

Tokenomics (Token-economics) is an increasingly popular field in web3 which studies the math and incentives governing crypto assets. In simple terms, it boils down to 2 things that matter most for a token’s value: Supply & Demand

Supply: The supply of a token is going to directly impact how scarce it is and how its scarcity is viewed by individuals in relation to its value. Most important questions to ask about a token’s supply are:

How many of these tokens exist right now?

How many will ever exist? How are these distributed?

How quickly are new ones being released?

For example, there will only ever be 21M BTC, and they’re released at a rate that gets cut in half every four years or so. Roughly 19M already exist, so there are only 2M more to be released over the next 120 years. This makes it a very scarce asset for potential investors.

Demand: Having a fixed supply alone does not make something valuable. People also need to believe it has value, and that it will have value in the future. Most important factors that impact the demand for a token are:

ROI: How much income or cash flow is the token able to generate? For instance, you can get 5% APR for staking ETH. If a token has no intrinsic ROI or cashflows, then it’s harder to justify holding it unless you have….

Memes: How much faith does the community have in the token? BTC lives on the belief that it could be a long term store of value to rival gold. This kind of conviction from the community has a large impact on the token’s value.

Game theory: Is there a strong positive feedback loop that increases the demand for the token? This is one of the most interesting parts of Tokenomics. Classic example here is the Curve protocol with CRV token. You can lock your CRV tokens to earn a share of the Curve protocol revenue. Interestingly, the longer you lock your tokens for, the greater your rewards. So there’s less reason to sell if the price dumps. In addition, the more tokens you have locked and the longer you have them locked for, the lower your fees are, when you use all the other parts of Curve.

These high level mental models give an initial foundation to evaluate any new project you come across. Thanks to Nat Eliason for writing this thoughtful blog on Tokenomics. Highly recommend following him on Twitter for web3 content.

🫘 Quick nuggets

Facebook launched its metaverse product called Horizon Worlds allowing creators to create immersive social experiences for Oculus. The goal is to allow people to earn a living from creating virtual goods. Controversially, they announced a whopping 47% take rate on all digital assets sold in this metaverse. These rates are similar to other platforms such as Roblox…. but insanely high compared to take rates in web3. This is why we need alternatives such as the Open metaverse being created by punk6529.

The largest crypto hack of 600M$ on Ronnin bridge has been attributed to North Korean hacker group Lazarus by the FBI. It is going to be extremely hard to cash the money out since hacker’s wallet address is blacklisted across several exchanges and blockchain apps. All activity related to the wallet can be easily tracked 👮🏽

Former BitMEX CEO and crypto billionaire Arthur Hayes has a bearish view for crypto in the short term. He reckons a drop in the Nasdaq 100, due to rising inflation and increasing interest rates, could drag BTC to around $30,000 and ETH to $2500. But he is bullish long term on crypto and thats the view we like to take. 📉

It is now more expensive to 51% attack ETH compared to BTC. 51% attack essentially means taking control of majority of the nodes validating transactions on a blockchain. Attack cost represents how much it would cost to rent enough hashing power to match the current network hashing power for an hour. ETH is becoming more secure than BTC 🗡️

How did you enjoy this week’s edition?

Like always loved reading the news letter, thanks! Would love to hear your views as an engineer, on how you see web3 unfolding in the coming years. Another interesting topic I think many of us would love to read is your crypto investment strategy. Cheers!