🤖 How a bot made 600k profit in a single transaction

This is Shashank’s Newsletter, a newsletter with bite sized content on everything that happened in web3 over the past week.

In today’s email,

🤖 How a bot made 600k profit in a single transaction

🆓 How to get negative interest rate loans on ETH

📈 Web3 Salaries soar to $900,000

🏴☠️ DeFi investor loses 1.5M$ in hack

💰 Goldman Sachs starts OTC Bitcoin options trading

Outsized crypto returns

This week, had to share Multicoin capital’s crypto investment returns instead of the regular weekly gainers. Multicoin capital, a $100M crypto hedge fund is probably one of the best performing funds of all time. They even beat BTC returns since 2017 💸

🤖 How a bot made 600k profit in a single transaction

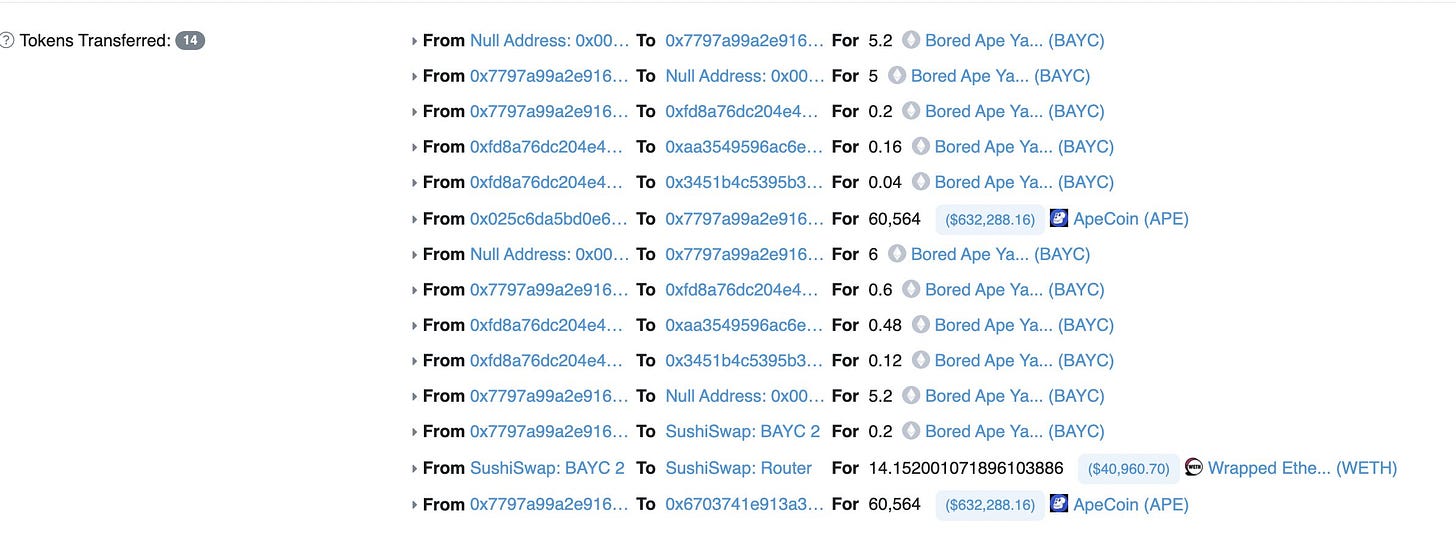

We talked about BAYC launching their own token in last week’s edition. This week, I wanted to share a crazy story of how a bot made over 600k$ in profit in a single transaction. We’ll need to understand a few concepts to get this.

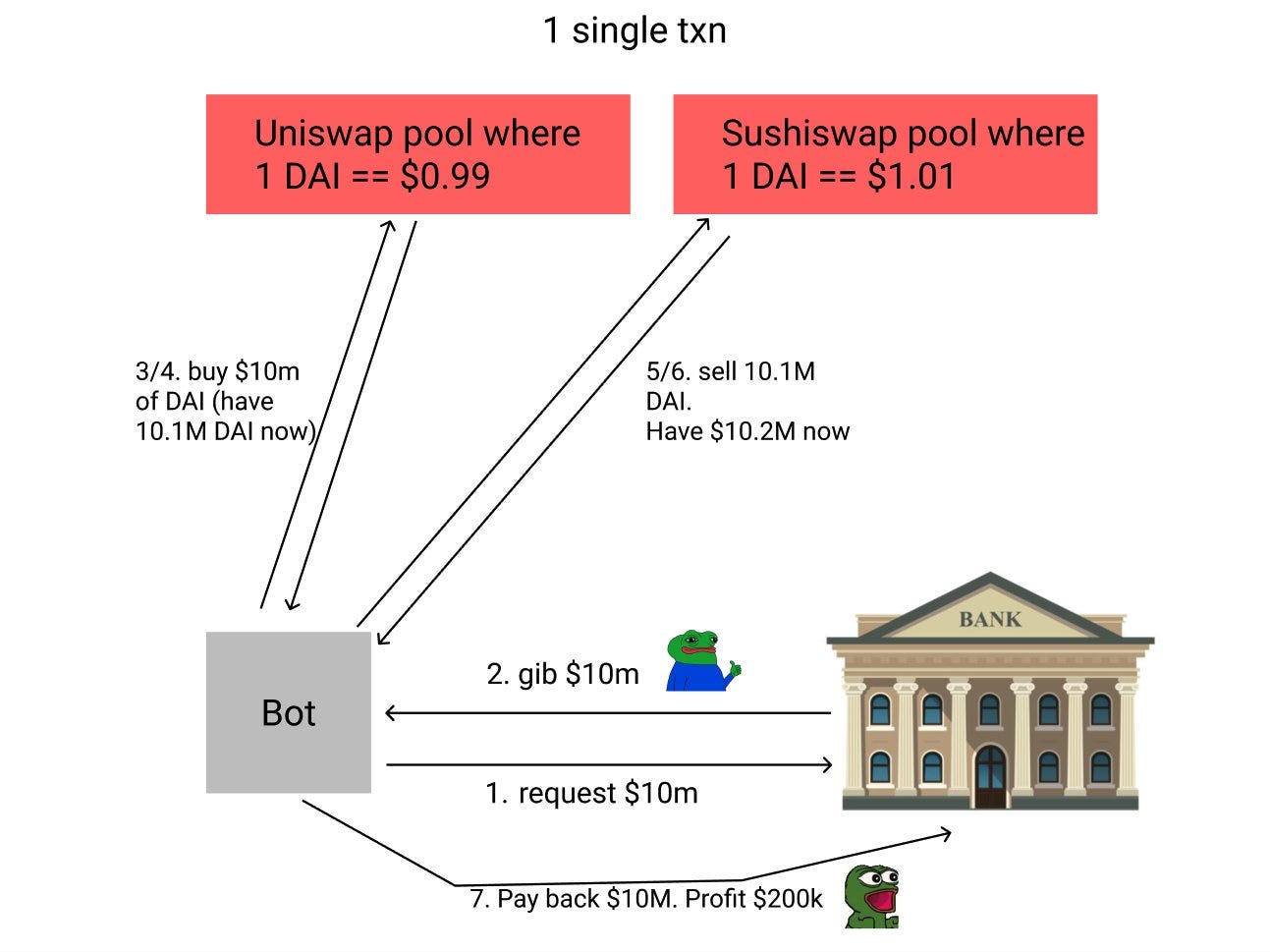

What are flash loans? Flash loans allow smart contracts to borrow large sums of money without any collateral as long as it is paid back at the end of the transaction. If it is not paid back in full, the transaction gets reverted. It is most commonly used for arbitrage opportunities like the one below.

What is NFTx? NFTx provides liquidity for illiquid NFTs. For example, you can lock up your BAYC NFT (ERC721) in a vault and get 1 vBAYC token (ERC20) back. You can redeem your NFT from the vault by giving back your vBAYC. Idea is that vBAYC can be traded and composed more easily than the NFT.

Now let’s get into the bot transaction.

Bot gets a flash loan of 5.2 vBAYC tokens from the NFTX vault.

Bot swaps out its vBAYC tokens for 5 BAYC NFTs.

Bot calls the $APE airdrop contract and claims all the $APE tokens for its 5 BAYC NFTs. Netting ~$600K.

Finally, the bot transfers the NFTs back to the NFTX vault to redeem back vBAYC tokens to repay the loan (with a flash loan fee).

Funnily, the code to do such arbitrage using NFTx was done in the past and open sourced here. If you really wanted to, there are lots of resources online to participate in such arbitrage opportunities right now - everything is open source. Imagine hedge funds open sourcing their front-running strategies. This is what is cool about web3 being an open, permission-less and level playing field.

🆓 How to get negative interest rate loans on ETH

Say you want to borrow against your $ETH stack and use that to buy an apartment or a car, how do you do that? Let’s understand a couple of concepts to achieve this.

What is stETH? Lido’s stETH is a liquid token representative of staked ETH. When a user stakes their ETH with Lido, the user will be granted an stETH token which rebases once a day to reflect their staking rewards. You can learn more about staking in my previous post.

What is Aave? It is a decentralized, permissionless lending platform that allows any user to supply their assets to earn interest, or to borrow other assets by users supplying their own assets as collateral.

Now, how do you get a negative interest rate loan using your ETH stack?

1. Convert ETH to stETH using Lido

2. Deposit into Aave (4.5% APR)

3. Borrow USDC (2% APR)

4. Withdraw USDC to bank account to buy a house or car

In a nutshell, this works because borrowing rates for ETH across DeFi lending protocols are much lower than the interest gained by staking. Also, the borrowing rates are lower in DeFi compared to TradFi due to highly capital efficient protocols.

By the way, this is how rich people like Larry Ellison, Elon Musk live by taking low interest loans off their billions of assets in stocks without ever selling them. It’s cool to see DeFi open this to everyone.

📈 Web3 Salaries soar to $900,000

Web3 companies are catching up and steaming ahead of FAANG compensations. Here are some of the recent job postings:

Silo Finance, a lending protocol, reported salary ranging from $300,000 to $750,000

TempleDAO, a DeFi investment platform posted a job paying $300,000 to $900,000

LooksRare also offered a package that topped $600,000

The job market for devs is 🔥🔥 It’s clear that web3 engineers are getting paid extremely well, and token-based comp is similar to the stock option-based comp.

If you are piqued by the mission driven and creative nature of crypto, reach out to me at 0xshash.eth@gmail.com and I can help you navigate the web3 space for a developer job.

🏴☠️ DeFi investor loses 1.5M$ in hack

Arthur Cheng, crypto investor and founder of DeFianceCapital fell prey to a phishing attack and lost 1.5M$ in crypto assets. Ouch….

So, how did this happen? He got a phishing email that looked like it was from one of his portfolio companies. Opening the google doc link seemed to proceed to a normal PDF document which may also have compromised the seed phrase or private key of his wallet. And 72 hours later, his wallet was drained of 22 valuable NFTs + tokens. Interestingly, this malware was not even caught by the anti-virus software on the machine.

It is definitely sad that crypto hacks are a very common occurrence even among regular crypto users who are fairly advanced. There are lots of different attack vectors and once they gain access to your machine, it can be detrimental.

Stay safe out there and follow some best practices.

💰 Goldman Sachs starts OTC Bitcoin options trading

Goldman Sachs, one of the largest traditional financial institutions becomes the first major U.S. bank to trade crypto over the counter. They did this in partnership with Galaxy Digital, a crypto investment firm.

What is over the counter trading? OTC is basically a private, more personalized service to institutions and high net-worth individuals needing to fill large orders that might be too disruptive if placed on open markets at the exchanges.

Hedge funds have been seeking derivative exposure to BTC, either to bet on its price without directly owning it, or to hedge existing exposure to it and Goldman entering this play is huge news for crypto industry.

The institutions are finally coming for crypto. Probably something….

How did you enjoy this week’s edition?