⚡ A successful merge

This is Shashank’s Newsletter, a newsletter with bite sized content on everything that happened in web3 over the past week.

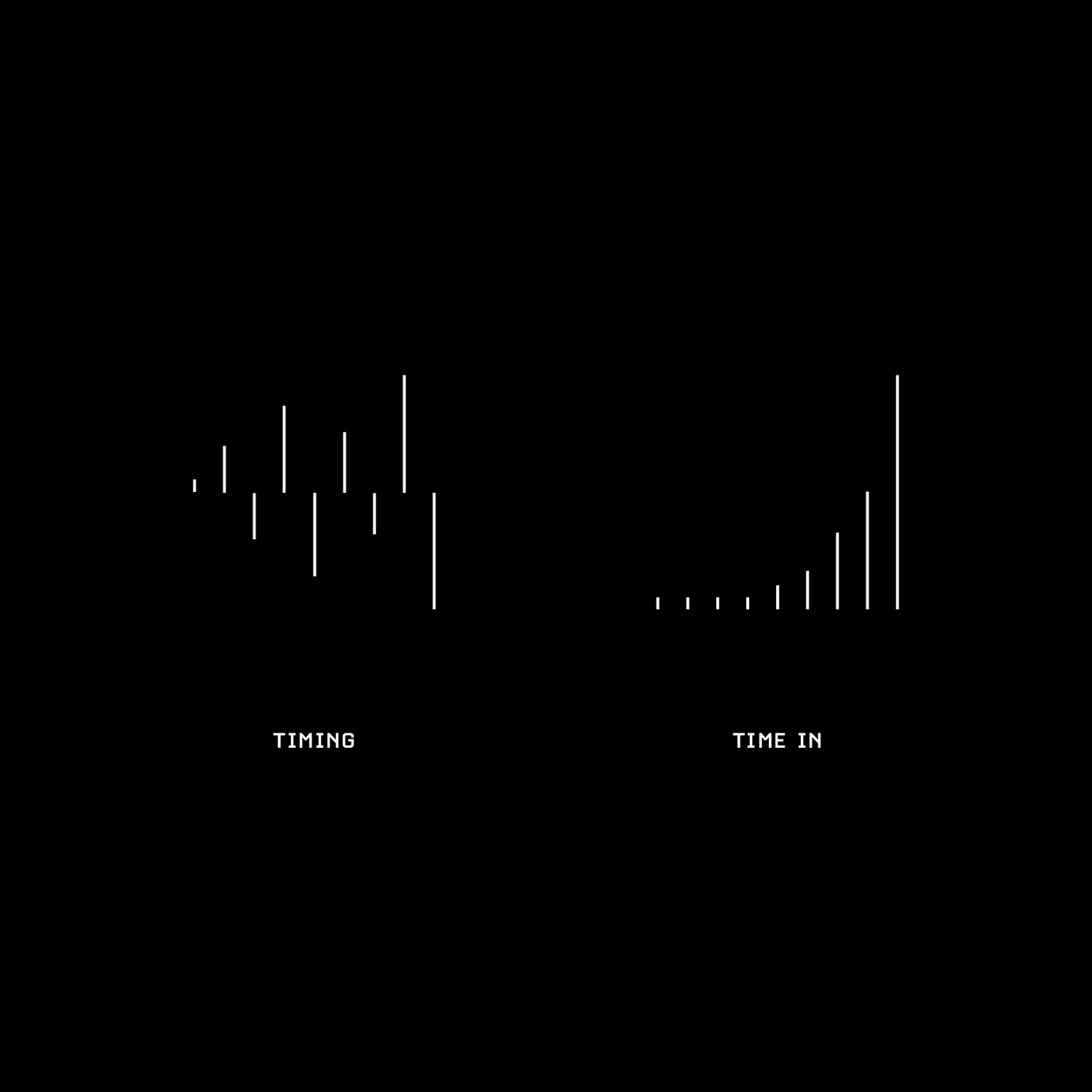

In times like these when all charts are bleeding red, remember that we are not in the job of predicting the markets and remember Buffet’s favorite philosophy around markets:

In today’s email,

⚡ A successful merge

🖼️ NFT data shows new buying habits

💳 State of DeFi

⚖️ New crypto law in Senate

🌯 Some cool beans

⚡ A successful merge

Long awaited ETH merge is finally happening and closer than ever. ETH Merge was a MAJOR success on Ethereum’s testnet Ropsten. Congratulations to all the devs involved on achieving such a huge milestone 🎉

After the merge, ETH is more secure and more energy efficient. It also massively reduces the sell pressure from miners.

So, how does the merge work? Ethereum blocks consist of execution layer and consensus layer. With merge, the execution layer doesn’t change and consensus changes from Proof of work (PoW) to Proof of stake (PoS). This means that block producers can use their existing Ethereum nodes without any upgrades, since the consensus nodes for PoS live separate to the execution nodes. In the actual "transition block", PoS validators are watching the PoW chain (essentially a chain of blocks), and watching for a terminal condition that has been agreed upon, and then they can move over to the new chain.

So, what happens next? 2 more public testnet merges on Goerli and Seoplia are expected to happen in the coming months and then mainnet.

🖼️ NFT data shows new buying habits

Nansen recently relased their some interesting NFT trends:

Trading volume seems to be down but similar to Sep 2021

Degens are still trading free mints looking at Opensea transaction data

Returning buyers hit all time high

In conclusion, Nansen’s data shows people are here, and willing to spend, but in smaller amounts. The market is alive, but the psychology isn't the same as it was.

💳 State of DeFi

Jack Niewold put out a great thread on Twitter about the current state of DeFi. Here are 2 key charts:

Protocol revenues are down big time compared to end of last year. This includes projects like Uniswap and Aave which in my opinion hit Product market fit. The top 10 biggest protocols managed to cross $10M in daily rev at the cycle peak, they can barely get past $1M today.

Alt-L1 activity is getting crushed. With reduced demand for transactions, Ethereum gas fees are really low and it makes Ethereum a lot more attractive relative to alt-L1s.

⚖️ New crypto law in Senate

Some of the key highlights from the bill

First up, Congress is working hard to provide web3 builders with regulatory clarity which is in itself a big win even if the bill is not perfect in its current shape

Most assets will be classified as commodities and not securities. This means that CFTC (Commodity Futures Trading Commission) would be overseeing the regulations and not the SEC (Securities Exchange Commission). One flaw with this is that CFTC might want to control what assets trade on a platforms like Uniswap for example. This is simply not practical for permissionless DeFi protocols.

For tokens that are considered as securities, the teams will have to do lightweight SEC reporting

Stablecoins need to declare sufficient liquid reserves to back them up

🌯 Some cool beans

Crazy stats on how the NFT market has been driven purely by vibes and memes. Goblins NFT collection generated more royalties than some of the blue chip NFTs combined 📈

First they ignore you, then they laugh at you, then they fight you, and then you win. TradFi platforms are quietly building crypto platforms in bear season 🏦

Polygon is back with another major partnership with Circle after they announced big partnerships with Meta and Stripe. Polygon bringing absolute fire 🔥

How did you enjoy this week’s edition?